Growing Nuclear Energy Interest Spurring New Investment in Nuclear Fuel Cycle

It is clear nuclear energy is experiencing global resurgence, as countries look to meet growing demand with a reliable source that helps provide energy security and meet climate targets. And interest in the sector is not limited to those countries which already have nuclear.

A host of new countries are investigating building nuclear plants for the first time, partly due to the emergence of smaller reactor concepts which are more affordable and more flexible than traditional GW units. With many countries now targeting significant growth in nuclear capacity between now and 2050, there is new interest in every stage of the nuclear fuel cycle—from uranium mining to spent fuel management—creating both opportunities and challenges for the nuclear energy sector.

This year’s World Nuclear Fuel Market Conference in Sydney will tackle some of these issues head on. Australia is a perfect location for this year’s event as the country weighs whether to lift a moratorium on the use of nuclear power despite the fact it is already one of the world’s major uranium producers.

Starting with uranium, both spot and long-term prices have more than doubled since 2021, due to both rising demand and the impact of geopolitical considerations which have essentially reduced Russia’s access to the Western markets.

Producers around the world are ramping up production and reviving projects that were on hold. For example, Cameco is looking to extend the life of its Cigar Lake mine by five to six years based on the strong demand.

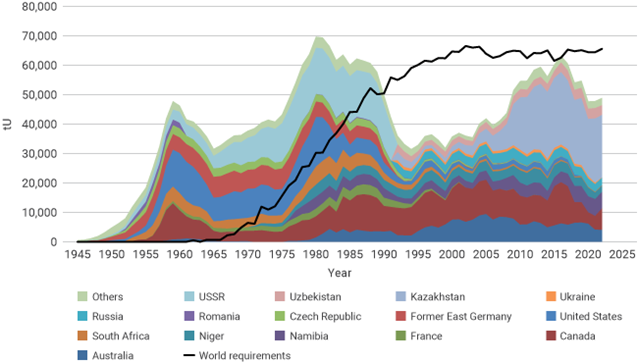

Still, global nuclear plant requirements are currently outstripping supply and more investment is needed, according to the World Nuclear Association (WNA).

World uranium production and reactor requirements (tonnes U)

Sources: OECD-NEA, IAEA, World Nuclear Association

Global enrichment capacity is facing growing geopolitical and logistical challenges, especially as Western nations seek to diversify away from Russian suppliers. This is prompting several producers to expand their capacity at existing facilities while others consider building new enrichment facilities such as Orano’s proposed facility near Oak Ridge, TN. In addition, several producers are either adding or considering new capacity to produce high-assay low-enriched uranium (HALEU) for advanced reactors fuel.

Demand for fuel fabrication is expanding along with other parts of the fuel cycle such as conversion. Interest is high for fuel designed for small modular reactors (SMRs), whether they are conventional light-water designs or advanced reactors that use different types of fuel.

The recent news that many major global companies in the technology sector signed up alongside dozens of countries in the commitment to triple nuclear capacity by 2050, will further encourage more investment in every part the nuclear fuel cycle. However, developing new fuel cycle facilities is a challenging prospect and experts warn that inadequate supply could impinge on nuclear energy’s global resurgence.

All of this – on top of uncertainty in global trade markets in a time of tariffs, conflict, potential solutions and the inevitable unpredictability of the modern world – makes attendance at the upcoming World Nuclear Fuel Markets Annual Meeting and International Conference an imperative for those who want to hear the latest developments in the industry and discuss their implications. If you’re one of those people, you can register now using the link above.

Dave Culp is Executive Director of World Nuclear Fuel Markets and NAC’s Vice President, Consulting.